Dataskyddspolicy | GDPR

Dataskyddspolicy | GDPR

Riktlinjer för hantering av personuppgifter för ROPA management AB (556647-0703) med bifirma BOARDA. På ROPA/BOARDA har vi två register.

Intressenter | Vi har ett kontaktregister för kontakter och intressenter. ROPA/BOARDA samlar in e-postadresser via hemsidan och via e-post för intresse om ROPA/BOARDAs tjänster och event. Syftet med insamlingen av e-postadresser är att informera närverk och intressenter om bolagets tjänster och bjuda in till event. Vi grundar detta på en intresseavvägning.

Kunder | ROPA/BOARDA är företagstjänster. Vi har ett kundregister med de uppgifter som krävs enligt bokföringslagen. Våra avtal/villkor innehåller reglering av behandling av personuppgifter som vi lagrar enligt gällande lagstiftning. Vår hemsida hostas av loopia.se.

Så här gör vi | ROPA/BOARDAs insamlade uppgifter lagras via molntjänsten Storgate.se på servrar i Sverige och delas inte med bolag i eller utanför EU. Vi använder molntjänsten Mailchimp.com för utskick till våra intressenter och för insamling av nya e-postadresser via hemsidan. På alla våra utskick finns en tydlig knapp där det enkelt går att avanmäla sig från fler utskick eller använd knapparna nedan. Uppgifterna i vårt register för intressenter sparas så länge vi bedömer att det finns intresse för ROPA/BOARDAs tjänster och nätverk.

Uppgifterna i vårt kundregister sparar vi så länge vi behöver enligt bokföringslagen.

Visselblåsning | ROPA/BOARDA erbjuder en rapporteringsfunktion för visselblåsning i digitaltjänsten på BOARDA.se. Vi lagrar inga personuppgifter från inkommande ärenden, ev. personuppgifter som kommer in raderas så snart frågan lämnats över till aktuell kund.

Kontakt | Vill du ändra, radera eller veta vilka uppgifter vi har i register om dig så kontakta Jenny Rosberg, ROPA, via e-post jenny.rosberg@ropa.se eller telefon 08-408 10 200.

Klagomål | Kontakta Dataskyddsinspektionen

Events & iRtalks

Sign up here for the event

- Focus: Learn how to hold investors' attention through clear and structured presentations.

- Intention: Set your intention before every meeting, video, one-to-one, from stage and how it affects your investor relations.

- Opening Strategies: Discover effective opening strategies to make a strong first impression.

- Hiss pitch: Tools to practice and improve your elevator pitch to quickly and effectively communicate your message.

- Investor presentation: Build and deliver a compelling investor pitch that drives results.

- Handling questions and answers: Learn techniques to handle questions and answers in a professional manner.

- Present for results: Strategies for presenting financial information and creating good relationships with investors.

…our events went online

Welcome to our event space, sign up here to get invitations to our webinars. Most of our webinars are in SWE so please let us know if you want to be on the ENG or SWE invitation list? We always put our events on-demand, you can access them via the link below. You pay with your e-mail address. A warm welcome! Jenny

Så mycket enklare på börsen!

Coaching tips varje månad hittar du på BOARDA.se, ROPAs plattform för digital rådgivning on-demand. Där erbjuder vi kvalificerad rådgivning för arbetet i ledning och styrelse – strategisk planering, finansiell information, insiderinformation, MAR, obligatorisk information, investerarrelationer och bolagsstyrning. | Jenny Rosberg, ROPA & BOARDA

BOARDA | Our Digital Corporate Advisory

BOARDA | Our Digital Corporate Advisory

BOARDA | is a new subscription service from ROPA targeting the Chairman, CEO and CFO in SME companies. We have more than 100 sessions live on the platform with everything you need for the strategic planning, risk management, governance, investor communications, disclosures, insider information, financial reporting and investor relations.

Fast forward, nice and informal events.

Fast forward, nice and informal events.

Let us know if you want to get invitations to our events and we will put you on our mailing list.

På de fem första luncherna har bl.a. Lars-Erik Sjöberg och David Kroon, Carnegie, Lennart Danielsson, Partner börsrevisor PwC, Tomas Strömberg, Partner och börsrevisor Deloitte, Lauri Rosendahl, President Nasdaq Stockholm, Mats Gustafsson förvaltare Lannebo fonder, Eric Sprinchorn, Swedbank Robur, Caspar Callerström EQT, Ulf Rosberg, Partner NC Advisory, Bengt Maunsbach, Partner Altor Equity Partners, Thomas Eldered, VD Recipharm, Jörgen Rosengren, VD Bufab och Jan Svensson, VD Latour medverkat.

Contact

JENNY ROSBERG

Founder | CEO | ROPA & BOARDA

+46 70 747 27 41 | jenny.rosberg@ropa.se

Biography Jenny Rosberg

Biography Jenny Rosberg

+ 35 years international and operational experience from Senior Management and Board positions in the Financial and Technology Sector; Leadership, Strategy, Business Development, Sales, Organic growth, Acquisition driven growth, Turn-around situations, Mergers, Acquisitions, Cross-border transactions, Finance, Investor Relations, Governance, Strategic communications, Corporate Finance, Investment Management, Capital Markets, IPO services and more. MBA Stockholm School of Economics

Board member and Chairman in the Audit Committee MIPS AB (publ) Large Cap, board member AB Persson Invest, family office, board member and the M&A committee CAG (publ.) First North Growth Market Premier, board member and Chairman in the Audit Committee C-RAD AB (publ) Small Cap, Chairman Advisory board fam. Hamberg, Chairman Solporten Fastighets AB, Family Offices.

Business is about people and relationships.

Business is about people and relationships.

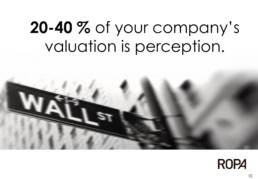

We can help you, and we will guide you. Investors, customers, employees, business partners, local communities, and the media are all prepared to tell your story, and if you don’t, they will. How these key constituents perceive your strategy, the activities you perform and adopt the messages you deliver is critical to closing the deal, maximizing sustainable value creation.

Advisory

The ROPA approach is to work with our clients as a partner.

The ROPA approach is to work with our clients as a partner.

We strive to have this mindset throughout every aspect of every client engagement – from customizing our advisory solutions for each client, to our client communications, how we manage meetings, complete work deliverables and meet deadlines.

We use our cohesive blend of financial, operational and industry experience to quickly identify the drivers of your particular business och transaction challenge.

Please also see our digital corporate advisory on BOARDA.se. Available in Swedish only so far. More than 100 sessions live audio/video, guidance, templates, check-lists and documentation. Everything you need for the board and the management in a public company or when you are scaling-up. The digital service is divided into three themes: Strategy, Risk & ESG, Information & IR.

This is our services

Understanding where you want to be and how to get there.

The strategy of managing and communicating value is the understanding of people, performance, timing, transparency and targeting. We help you develop your capital market strategy, your company’s ”Equity Story” and ”Investment Case”. Perception is 20-40 percent of your Company’s valuation.

ROPAs differentiation is our deep-rooted experience in the financial markets – our knowledge and insight. Our background from management in C-level positions and leadership experience helps us understand your situation and your prioritization. We help you manage your transaction, situation or issue. Corporate Governance best practice and sustainable value creation are a natural part of our advisory services.

Investors, customers, employees, business partners, local communities, and the media are all prepared to tell your story, and if you don’t, they will. How these key constituents perceive and adopt the messages you deliver and the activities you perform is critical to closing the deal, maximizing equity and building brand value.

What are the options and opportunities?

We help you evaluating options and opportunities for the next step. Be it development for your company and or the ownership of your company. This has developed into a niche for us. We have helped several entrepreneurs the past years, mainly within the technology and services industries.

Our approach is grounded in capital markets.

We provide expert counsel and access to a strong Nordic and international network of investors and influencers – decision-makers that trust usand whom we trust.We help you see your company as Wall Street and Capital Markets will see it.

With ROPA as your partner, you’ll establish the relationships and the investor confidence that you need tobuild long-term value and lower cost of capital. We understand how to strengthen your investment story.We guide you to anticipate the questions that you will be asked because we’re tuned into the fluctuationsand ever-evolving expectations for the market.

IPO OFFICE is your IPO Advisor – ROPA provides resources, knowledge transfer and expertise during the IPO process. Successful IPO’s need expert support on their side of the table as their advocate to coordinate this complex process. We coordinate all involved parties and stakeholders to ensure market readiness and communications are aligned. Resources, knowledge and expertise are areas in which many pre-public companies fall short. ROPA’s network includes several available Investor Relations experts as well as board members, qualified for NASDAQ Stockholm.

ESG Meaningful but not painful

- E, S, G Questionnaires

- According to Taxonomy

- SWOT from E, S and G perspective

- Prioritization short- and long term activities

- Identify E & S risk factors – [ G-factors]

- Identify E & S business & investment opportunities

- Identify 1 SDG including sub goals on level 2

- Indicative mid-term ambition level

- Initial Investor Analysis output

Credentials – Team

- MBA, Stockholm School of Economics

- +30 years international and operational experience from Senior Management and Board positions;

- Extensive experience in Strategy and Business development, Sales leadership, Managing organic growth as well as Acquisition driven growth;

- Project leadership in Merger’s, acquisitions and cross border transactions;

- Advisor: Finance, Investor relations, Governance, Strategic communications, Corporate finance, Investment management and IPO services.

___

- B.S. Business Administration, Finance; MBA, concentration Finance; Post Graduate degree, Principles of the Circular Economy, including comprehensive research on Business Model Adaptions, graduated with distinctions

- +30 years extensive experience and understanding of financial markets, including listings/capital raising;

- Environmental projects with an emphasis on opportunity development and business model adaptations; strategic focus and understanding of business implications;

- Company case studies on environmental impact opportunities.

Private and Public market transactions.

Jenny Rosberg, the founder of ROPA, has long operational and international experience from doing private and public market transactions in the technology sector and services industry. She knows from the inside the ”pros and cons,” how to approach targets, positioning, negotiating, managing and closing the deal.

Our capital market’s expertise gives us the network and insight to develop strategy, identify strategic, industrial and financial investors, manage the transaction and communicate with the capital market constituents as well as employees, customers, the financial media, and other stakeholders.

A function of preparedness and experience.

ROPA brings comprehensive experience to risk assessment, planning, and preparation for a wide range of contingencies, and we provide expert counsel as events unfold.

A crisis can be catastrophic to any corporate reputation. But a smart, proactive response can turn it to your favor. A company that can withstand the inevitable slings and arrows of the modern world will be well-respected and highly valued. Our capital markets expertise and integrated approach to strategy and communications ensures that all activities are timely, consistent, and will clearly address the issues and expectations of all key stakeholders.

More than 100 sessions live in our digital corporate advisory on boarda.se

We complement our traditional advisory services with our digital channel BOARDA. BOARDA helps business leaders, boards and owners to set the strategic agenda, manage risk, communication and disclosure in the marketplace. An easy and efficient way to get guidance, inspiration and motivation. Our Digital Corporate Advisory Services can be used separately or in a package with traditional advisory services from ROPA.

Guidance

Rules and best practice.

Rules and best practice.

Målsättningen med vägledning är att ge dig (och oss själva) senaste versionen av god sed och regelverk för aktiemarknaden på ett ställe så att du enkelt kan hitta och dubbelkolla. Some information in English.

Updated on August 16, 2018.

Aktuella regelverk och praxis för den svenska aktiemarknaden

→Så här registrerar du din insynshandel hos FI

→NASDAQ Stockholm guide – frågor & svar på svenska här

→NASDAQ Stockholm guidance – Q&A in English here

→Uppdaterad praxis MAR – insiderreglerna från Vinge & MSA

→Uppdated guidance MAR in English – insider rules from Vinge & MSA

→Länk till rapportering av insynshandel hos Finansinspektionen här

If you are not a Swedish citizen, please, do not buy any shares in a company in which you are obliged to report your holdings to the FSA prior to having done a registration of your user profile at the FSA. You need to have your profile registered to get access to the FSA system for your reporting. The system is developed for Swedish citizen who has the local Bank-ID.

→Nasdaq First North Rulebook uppdaterad, se Premier segmentet.

→Exempel på pressmeddelanden | Vinstvarningar

→Nasdaq Regelverk för emittenter – Regler för informationsgivning januari 2018↓

→Nasdaq Rulebook for issuers in English – January 2018↓

→First North Rulebook – Regler för informationsgivning mm – January 2018

→Aktietorget Regelverk och vägledning

→FAR FQA Hållbarhetsrapportering enigt ÅRL

→ESMA Riktlinjer alternativa nyckeltal

→Nasdaq rapport från övervakning av regelbunden finansiell information (finansiella rapporter) 2016

Nytt – bolag på väg till eller noterade på Nasdaq First North Premier ska tillämpa svensk kod för bolagsstyrning.

→Svensk kod för bolagsstyrning – Gällande från december 2016

Advisory Services

Start

Welcome to an advisory firm based on real expertise and real results.

Welcome to an advisory firm based on real expertise and real results.

ROPA is a Corporate Advisory Specializing in Capital Markets. We help business leaders, boards’, owners and entrepreneurs with Strategy, Management & Communications, Transactions, Mergers & Acquisitions, Crisis Management & Special Situations, Investor Relations and IPO’s. Our Services:

Watch and read our blog.

Watch and read our blog.

Here you will find our thoughts, ideas, guidance, news, important stuff, events and things that we care about.

| The Blog

You will find ROPA's digital corporate advisory on BOARDA.se.

You will find ROPA's digital corporate advisory on BOARDA.se.

Our advices are based on operational and international experience.

Our advices are based on operational and international experience.

Jenny Rosberg is the founder and CEO of ROPA management Ltd (AB). ROPA is the corporate advisory firm specializing in Capital Markets. In 2019 ROPA launched its Digital Corporate Advisory BOARDA.se helping business leaders and boards’ in SME-companies. She is also board member in MIPS AB (publ), AB Persson Invest (family Office), CAG Group AB (publ), C-RAD AB (publ) and Chairman of the board in Solporten Fasighets AB (Family Office). Selected prior board assignments include Net Ent AB (publ), Länsförsäkringar Stockholm, Nordax Bank and Nordax Group AB (publ), Eastnine AB (publ),Nasdaq Stockholm AB, Nasdaq Helsinki Oy, Nasdaq Copenhagen A/S and Nasdaq Iceland hfr. Prior to founding ROPA she held the position as Senior Vice President of Nasdaq Group Inc. (NASDAQ:NDAQ)