The ROPA approach is to work with our clients as a partner.

We strive to have this mindset throughout every aspect of every client engagement – from customizing our advisory solutions for each client, to our client communications, how we manage meetings, complete work deliverables and meet deadlines.

We use our cohesive blend of financial, operational and industry experience to quickly identify the drivers of your particular business och transaction challenge.

Please also see our digital corporate advisory on BOARDA.se. Available in Swedish only so far. More than 100 sessions live audio/video, guidance, templates, check-lists and documentation. Everything you need for the board and the management in a public company or when you are scaling-up. The digital service is divided into three themes: Strategy, Risk & ESG, Information & IR.

This is our services

Understanding where you want to be and how to get there.

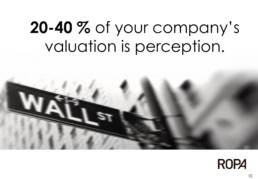

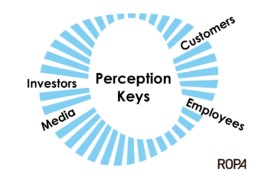

The strategy of managing and communicating value is the understanding of people, performance, timing, transparency and targeting. We help you develop your capital market strategy, your company’s ”Equity Story” and ”Investment Case”. Perception is 20-40 percent of your Company’s valuation.

ROPAs differentiation is our deep-rooted experience in the financial markets – our knowledge and insight. Our background from management in C-level positions and leadership experience helps us understand your situation and your prioritization. We help you manage your transaction, situation or issue. Corporate Governance best practice and sustainable value creation are a natural part of our advisory services.

Investors, customers, employees, business partners, local communities, and the media are all prepared to tell your story, and if you don’t, they will. How these key constituents perceive and adopt the messages you deliver and the activities you perform is critical to closing the deal, maximizing equity and building brand value.

What are the options and opportunities?

We help you evaluating options and opportunities for the next step. Be it development for your company and or the ownership of your company. This has developed into a niche for us. We have helped several entrepreneurs the past years, mainly within the technology and services industries.

Our approach is grounded in capital markets.

We provide expert counsel and access to a strong Nordic and international network of investors and influencers – decision-makers that trust usand whom we trust.We help you see your company as Wall Street and Capital Markets will see it.

With ROPA as your partner, you’ll establish the relationships and the investor confidence that you need tobuild long-term value and lower cost of capital. We understand how to strengthen your investment story.We guide you to anticipate the questions that you will be asked because we’re tuned into the fluctuationsand ever-evolving expectations for the market.

IPO OFFICE is your IPO Advisor – ROPA provides resources, knowledge transfer and expertise during the IPO process. Successful IPO’s need expert support on their side of the table as their advocate to coordinate this complex process. We coordinate all involved parties and stakeholders to ensure market readiness and communications are aligned. Resources, knowledge and expertise are areas in which many pre-public companies fall short. ROPA’s network includes several available Investor Relations experts as well as board members, qualified for NASDAQ Stockholm.

ESG Meaningful but not painful

- E, S, G Questionnaires

- According to Taxonomy

- SWOT from E, S and G perspective

- Prioritization short- and long term activities

- Identify E & S risk factors – [ G-factors]

- Identify E & S business & investment opportunities

- Identify 1 SDG including sub goals on level 2

- Indicative mid-term ambition level

- Initial Investor Analysis output

Credentials – Team

- MBA, Stockholm School of Economics

- +30 years international and operational experience from Senior Management and Board positions;

- Extensive experience in Strategy and Business development, Sales leadership, Managing organic growth as well as Acquisition driven growth;

- Project leadership in Merger’s, acquisitions and cross border transactions;

- Advisor: Finance, Investor relations, Governance, Strategic communications, Corporate finance, Investment management and IPO services.

___

- B.S. Business Administration, Finance; MBA, concentration Finance; Post Graduate degree, Principles of the Circular Economy, including comprehensive research on Business Model Adaptions, graduated with distinctions

- +30 years extensive experience and understanding of financial markets, including listings/capital raising;

- Environmental projects with an emphasis on opportunity development and business model adaptations; strategic focus and understanding of business implications;

- Company case studies on environmental impact opportunities.

Private and Public market transactions.

Jenny Rosberg, the founder of ROPA, has long operational and international experience from doing private and public market transactions in the technology sector and services industry. She knows from the inside the ”pros and cons,” how to approach targets, positioning, negotiating, managing and closing the deal.

Our capital market’s expertise gives us the network and insight to develop strategy, identify strategic, industrial and financial investors, manage the transaction and communicate with the capital market constituents as well as employees, customers, the financial media, and other stakeholders.

A function of preparedness and experience.

ROPA brings comprehensive experience to risk assessment, planning, and preparation for a wide range of contingencies, and we provide expert counsel as events unfold.

A crisis can be catastrophic to any corporate reputation. But a smart, proactive response can turn it to your favor. A company that can withstand the inevitable slings and arrows of the modern world will be well-respected and highly valued. Our capital markets expertise and integrated approach to strategy and communications ensures that all activities are timely, consistent, and will clearly address the issues and expectations of all key stakeholders.

More than 100 sessions live in our digital corporate advisory on boarda.se

We complement our traditional advisory services with our digital channel BOARDA. BOARDA helps business leaders, boards and owners to set the strategic agenda, manage risk, communication and disclosure in the marketplace. An easy and efficient way to get guidance, inspiration and motivation. Our Digital Corporate Advisory Services can be used separately or in a package with traditional advisory services from ROPA.