Advisor to Leaders, Entrepreneurs & Boards

I support business leaders, entrepreneurs, and owners in navigating what matters most. With close to 40 years of experience in executive leadership, boardrooms, and capital markets, I bring deep insight — bridging strategy, financing, governance, investor relations, and human decision-making.

I’ve stood alongside CEOs, CFOs, boards, and owners through transactions, transitions, IPOs, financing and special situations — or as ongoing support, step by step, driving growth and profitability across global, European, Nordic, and Swedish markets.

I know the pressure. I know what’s at stake. That’s why I keep it clear, steady — and human.

Advisor to Owners & Family Offices

I help family offices and owners navigate the intersection of legacy, investment strategy, ownership with governance, and leadership.

I’ve supported transitions from founder to next generation, from second to third generation, aligned investment strategies with long-term vision, and helped build governance structures that support both continuity and change.

I understand the dynamics of relationships and ownership, and the discipline of long-term value creation — and how to hold space for both stability and renewal.

Digital Advisory

Smart. Simple. Efficient.

On-demand advisory with over 130 sessions targeted to CEOs, CFOs, and Chairpersons.

Ledership Practice

For leaders ready to move beyond management-as-usual — practice to find your unique leadership code.

The Offering

Understanding where you want to be and how to get there.

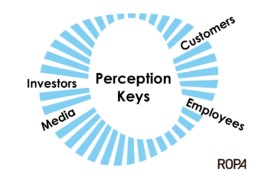

The strategy of managing and communicating value is rooted in understanding people, performance, timing, transparency and targeting.

I support you through transactions, financing, investor relations, transitions, special situations and issues or on an ongoing basis to drive growth and profitability — always with governance best practice and long-term value creation in mind. With a background in C-level management and boardroom leadership, I understand your reality and what drives your priorities.

What sets me apart is deep-rooted experience in the financial markets — and the insight that comes with it.

I help you shape your capital markets strategy and sharpen your company’s Equity Story and Investment Case. Perception can account for 20–40% of your company’s valuation.

What are the options and opportunities?

I help you evaluate options and opportunities for your next step — whether you’re developing your ownership as an entrepreneur or as a family office. Over time, this has become a niche for me.

I’ve supported transitions from founder to next generation, from second to third generation, aligned investment strategies with long-term vision, and built governance structures that support both continuity and change.

I’ve also supported entrepreneurs preparing to sell their business — and take the next step in their journey.

I understand the dynamics of ownership and relationships, the complexity of family systems, and the discipline required for long-term value creation. I know how to hold space — for stability, for renewal, and sometimes, for letting go.

Our approach is grounded in capital markets.

With ROPA as your partner, you’ll build the relationships and investor confidence that support long-term value.

I help you prepare for financing rounds, strengthen your investment story, increase your visibility, and get ready for the questions that matter — because I stay close to the market and the signals it sends.

ROPA offer knowledge transfer and expertise during the IPO process supporting the CFO, CEO and owners. Successful IPO’s need expert support on their side of the table.

Smart. Simple. Efficient.

On-demand advisory with over 130 sessions targeted to CEOs, CFOs, and Chairpersons.

Reignite your leadership

For leaders ready to move beyond management-as-usual — and lead with presence, purpose, and joy.

Experience gives perspective — presence builds trust.

I’m driven by curiosity about people and relationships — perhaps that’s why I’m so often drawn to entrepreneurial companies and founder-led businesses. That’s where vision, ownership, and decision-making truly intersect.

Clients often tell me they come for the advice — but stay for the energy. I bring clarity, momentum, and a positive force that helps move things forward.